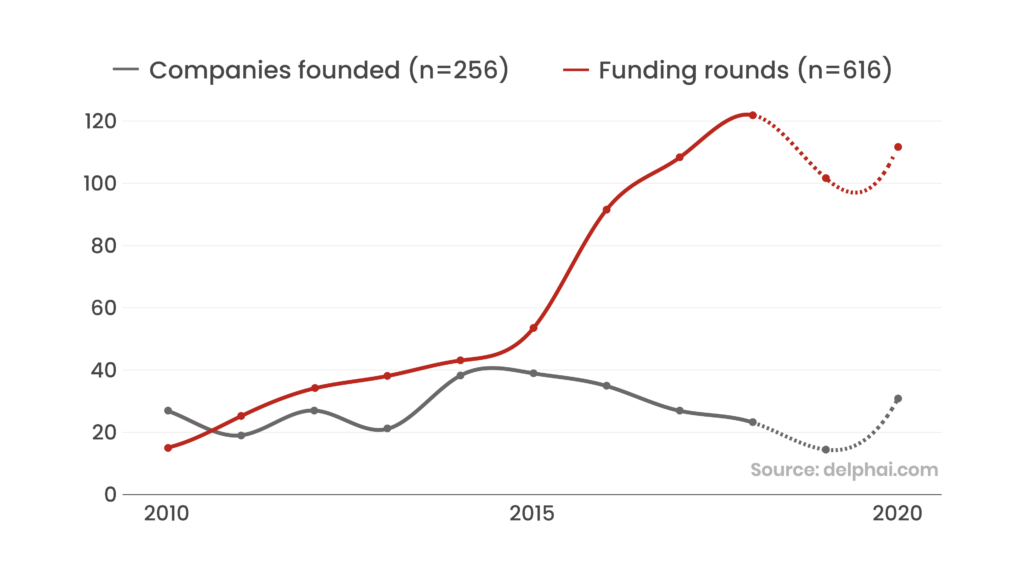

1. Heavy funding appetite for scaling. On average, 28 new electric vehicle companies entered the market each year between 2010 and 2018, with founding rates slowing slightly after 2014. In the same period, however, the number of yearly financing rounds jumped eightfold from 15 to 122 rounds. Correspondingly, yearly investment totals grew from €311m in 2010, to the €17.3bn poured into the sector in 2019. The slowdown in foundings alongside accelerating investor participation indicate that existing firms are raising capital to scale and further develop their solutions.

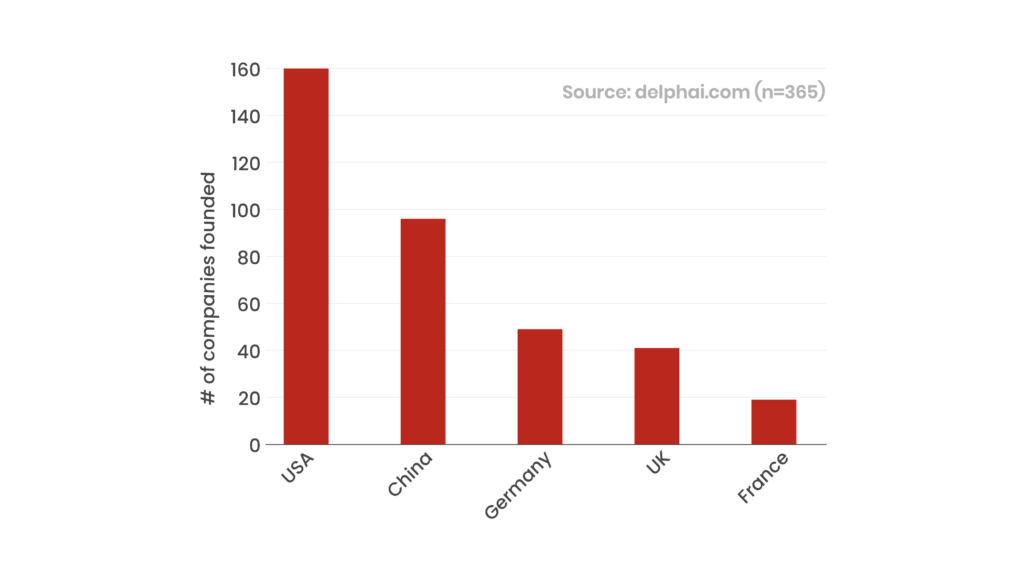

2. US and China in the lead. Of the 535 electric vehicle companies worldwide, 163 of them are from the US, and 96 are from China. Germany (45) and the UK (41) are the most active European centers, followed by France (19). The dominance of Chinese companies is particularly striking, with seven of the eleven mega funding rounds between 2016 and 2019 going to Chinese companies, and remaining four to US companies.

About this briefing:

This briefing is a part of a delphai collaboration with Tagesspiegel Background, in which delphai’s artificial intelligence tools are used to provide Background with data insights on the technologies, companies, and applications that drive global innovation.

The data and analyses you see here are a summary of what delphai provided to Tagesspiegel Background for its article Electromobility: not possible without us.

About delphai:

delphai is a market intelligence software that uses AI for the automatic analysis of market and technology developments. The software is used by companies to create insights that help them seize opportunities, manage risks, and make better decisions.

To learn more about our electric vehicles report, or how delphai can help your company grow, please get in touch here.