Most successful private equity (PE) firms have a robust deal-sourcing strategy supporting their buyout activities. PE deal sourcing traditionally has relied on one’s personal relations which is time-consuming and limits the amount of opportunity that can be identified. With current technological advancements, deal origination platforms have radically transformed sourcing by making it more structured, proactive, and efficient. So how do these platforms work? And how can PE firms leverage data tools in their sourcing strategies? Find out more below.

Traditional approaches

The buyout process of a PE firm is relatively self-explanatory at first glance. The steps are fundraising, deals monitoring and sourcing, seller identification, and bid placement. However, over 80 opportunities need to be sourced just to finally invest in just one single deal. Sourcing this number of leads becomes even more difficult when investing in private companies as they are not listed on the public stock exchange and, thus, difficult to gather information on. While PE deal sourcing might not be the easiest step of the entire process, it’s an essential step for these firms. Once the best opportunities are sourced and pursued, they can prove incredibly profitable.

Sourcing and evaluating a single deal requires a great number of human resources to discover, assess and close a deal. With the traditional approach, this meant spending days networking in search of the most valuable deal opportunities. However, time is often a scarce resource, limiting the number of opportunities that can be evaluated. Even more so, the entire sourcing process is often still performed manually. This inefficient workflow typically includes Google and Linkedin searches, ownership and funding checks on Pitchbook or Crunchbase, and gathering personal contact information. By adopting a structured sourcing process precious time could be saved and dedicated to the valuable evaluation processes.

Stay ahead or fall behind

The PE market has become increasingly competitive due to a large number of players. IIn this environment, PE firms should make improvements in deal sourcing that significantly reduce the time spent searching for valuable deals. At the same time, there is intense pressure to find unique undiscovered opportunities with interesting valuations to sustain the business. Nonetheless, finding such opportunities is incredibly challenging as each region has an abundance of private companies. Combined with resource restrictions, a well-structured sourcing process using technologically-driven tools to find suitable companies must become a priority. PE firms will either keep up with technological developments to gain a competitive edge and stay ahead or maintain their traditional approach and risk falling behind.

Deal sourcing platforms

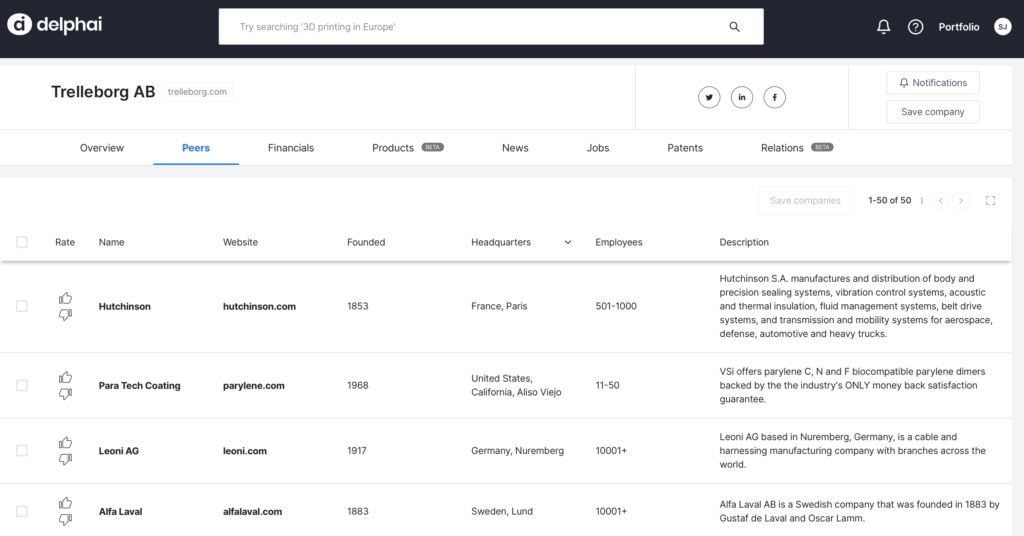

To source valuable leads, PE firms require accurate data and insight. Firmographic data is generally what PE firms are looking for. Firmographic data includes data points such as company name, industry, geographical area, size, and revenue. PE firms can easily gather the necessary firmographic data and gain a complete market overview by using, artificial intelligence (AI)-driven, B2B deal sourcing platforms like delphai. What makes these platforms efficient is that they allow PEs to filter and customize the search to the specific data point of interest. This way a lead list can easily be created within seconds. In the case of delphai, it is worth mentioning that the feature, delphai Peers, quickly finds companies similar to the initial company of interest. This is perfect for PEs, which want to find comparable companies for measuring metrics and gauging market performance.

According to Accenture sourcing platforms in the overall M&A market have the ability to generate hundreds of millions of dollars in value. Logically, applying this to the PE context, similar results can be expected. This can be explained by the potential to find companies that might not have been discovered via personal contacts. With the use of a sourcing platform, PEs can access a much larger domain of companies than they could possibly find through traditional processes. Not only will PE firms be able to find more unique get companies in less time but new high-potential targets are added daily. In other words, it allows them to stay ahead of company developments and trends.

Leading PE firms are starting to integrate data analytics into their strategies and procedures. By using integrated data hubs, PE firms can easily access and analyze all the data they need to make informed business decisions, all within a single platform. Deal origination tools are able to deliver more comprehensive and quality information quicker about a potential lead than traditional channels can produce. Therefore, we can expect deal-sourcing tools to become an indispensable part of the PE business landscape.

Curious to experience the benefits yourself? Book your demo here